This feature also allows you to monitor your payment schedule and incorporate it into your budget. You can connect your credit cards, student loans, and any other debts to your Banktivity account and keep track of your interest and principal. You will need the Direct Access feature for real estate and see the estimated price of your home through Zillow. Real Estateĭid you know that with Banktivity, you can connect your real estate to your mortgage accounts?

Security Management – allows you to see the current market value and your securities’ price history.Investment Tracking And Toolsīanktivity is pretty well-equipped for investments with various tracking tools such as: You need to pay an additional $44.99 annually to access Direct Access. You use this feature to sync and automatically import bank accounts, investment data, and transactions to improve your experience. It helps users set realistic and achievable goals for earning and spending. Users can use this option to plan around regular events and build flexibility for frequent unexpected expenses. It becomes easier to know when you need to adopt more affordable habits like switching to a cheaper cable alternative. It is highly effective since it forces you to think about your personal spendings critically. It is one of the essential features in a personal finance app, and Banktivity offers three different types of banking strategies that include: Envelope BudgetingĪlso referred to as zero-based budgeting, this option works by allocating money to certain expenses until you are back to zero.

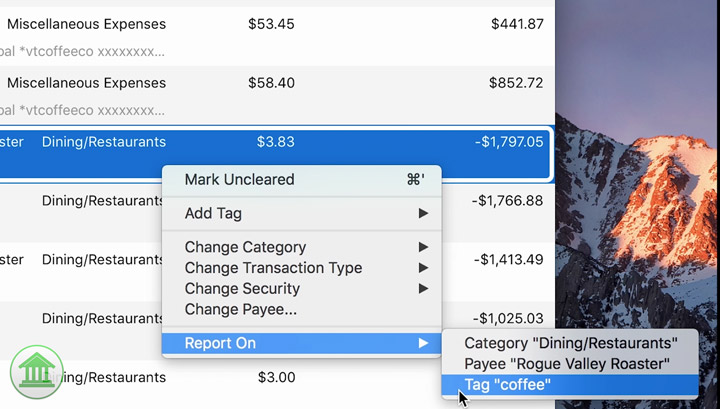

You can do this for each account you link to the platform. When you link an account to Banktivity, you can make notes, set minimum balance reminders, and store account numbers for reference. The folders will show you the totals based on everything in that folder, making it easier for you if you have accounts you don’t use regularly. The arrangement keeps your dashboard clean and organized. With Banktivity, you can connect over 14,000 different financial institutions and banks and arrange them according to type in folders. The new version 8 launched in 2020 also includes some new additional features whose aim is to make processes smoother. The platform offers users some excellent tools and features to track every bit of their financial status.

It is gradually developing and now stands at version 8.īanktivity claims that it can help users average $500 savings per year and 40 hours, an ROI worth the effort.īanktivity is becoming popular among Mac users since it offers features that Quicken has lacked for years, including online banking integration, loan amortization, and more.

BANKTIVITY FOR MAC REVIEWS SOFTWARE

The app was previously referred to as iBank, which IGG software later changed to Banktivity in 2016. It is a personal finance platform specifically designed for Mac users. This is where Banktivity from IGG software Inc.

BANKTIVITY FOR MAC REVIEWS MANUAL

Errors requiring manual correction after account importationįor most Windows users, Quicken is the most popular and ideal personal finance software.īut the Quicken version for Mac users has several disappointments and is not as efficient as it is for Windows users.Extra costs for online banking integration.

0 kommentar(er)

0 kommentar(er)